Dive Into Data: How Financial Services Can Make Waves with Their Free Salesforce Data Cloud Account

Salesforce Data Cloud is a game-changer for financial services companies looking to harness the full potential of their data. Despite its powerful capabilities, some organizations may be hesitant to adopt Data Cloud due to concerns about pricing or a lack of understanding about its features and benefits. In this blog post, we'll demystify Data Cloud, explore its key functions, and highlight why financial services companies should embrace this transformative technology.

What is Salesforce Data Cloud?

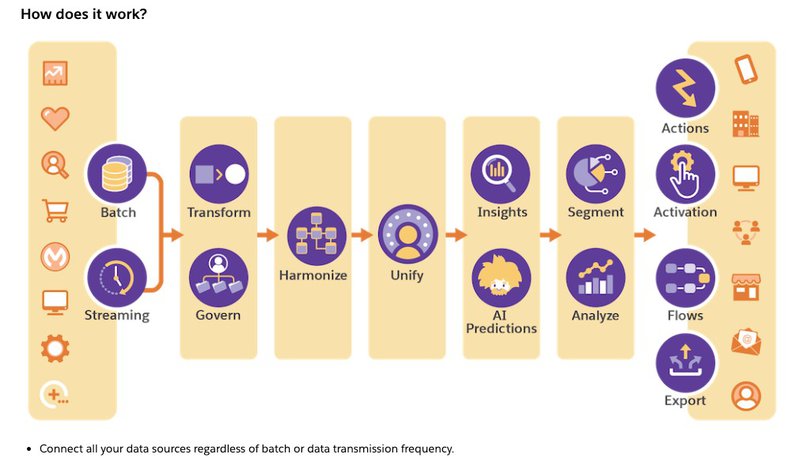

Salesforce Data Cloud, formerly known as Customer 360 Audiences or Salesforce CDP, is a customer data platform that enables organizations to unify, segment, and activate their customer data across various touchpoints. It allows businesses to create a single, comprehensive view of their customers by integrating data from multiple sources, including Salesforce and external systems. Data Cloud is built on Salesforce's foundational metadata layer, which provides a common language that integrates all Salesforce applications and low-code platform services, such as Flow for automation, Lightning for UI, and Apex for deep, pro-code customization. This powerful combination of data and CRM enables customers to build richer, more personalized experiences and connect all of this data in real time to Salesforce's powerful Einstein AI.

Key Features and Benefits of Data Cloud

- Data Unification: Data Cloud allows financial services companies to seamlessly integrate data from various sources, including Salesforce CRM, external systems, and data lakes. This eliminates data silos and provides a unified, real-time view of customers.

- Data Quality and Management: Data Cloud streamlines data processes and workflows through robust data management capabilities, such as integration, cleansing, and deduplication. This improves data quality and accuracy while reducing manual efforts and errors.

- Segmentation and Activation: With Data Cloud, financial services companies can create dynamic customer segments based on real-time data and activate those segments across various channels, such as email, social media, and advertising platforms.

- AI-Powered Insights: Data Cloud leverages Salesforce's Einstein AI to provide intelligent insights and predictions. This helps financial services companies make data-driven decisions, optimize customer experiences, and identify growth opportunities.

- Scalability and Security: As part of the Salesforce Platform, Data Cloud offers enterprise-level scalability and security features. It can handle large volumes of data and accommodate the growth of customer interactions while ensuring data privacy and compliance.

How Data Cloud Helps Financial Services Companies

Financial services companies face unique challenges when it comes to managing customer data, such as regulatory compliance, data security, and the need for personalized experiences. Data Cloud addresses these challenges and provides specific benefits for the financial services industry:

- Customer 360 View: Data Cloud enables financial services companies to create a comprehensive view of their customers by unifying data from various sources, such as banking systems, investment platforms, and insurance policies. This helps companies understand customer needs, preferences, and behaviors, leading to more personalized experiences and targeted offerings.

- Regulatory Compliance: Financial services companies are subject to stringent regulations, such as GDPR, CCPA, and FINRA. Data Cloud provides robust data governance and security features, ensuring that customer data is handled in compliance with these regulations. With Data Spaces, companies can logically segregate data, metadata, and processes for departmental, regulatory, and compliance needs.

- Risk Management: Data Cloud's AI-powered insights can help financial services companies identify potential risks, such as fraudulent activities or credit defaults. By leveraging machine learning models trained on unified customer data, companies can proactively mitigate risks and make informed decisions.

- Personalized Marketing: With Data Cloud, financial services companies can create targeted marketing campaigns based on customer segments and behaviors. For example, a bank can identify customers who are likely to be interested in a new credit card offer based on their transaction history and engagement data. This leads to higher conversion rates and customer satisfaction.

- Improved Customer Service: Data Cloud empowers financial services companies to provide exceptional customer service by giving agents a complete view of the customer's history, preferences, and interactions. With Service Intelligence, service teams can easily derive insights about the quality of their service and predict the propensity for escalations. Free Data Cloud Account for Enterprise Edition and Above

Dreamforce 2023 announced an exciting opportunity for Enterprise Edition and above customers to get started with Data Cloud at no cost. Customers can sign up for Data Cloud Provisioning under Your Account, which includes:

- 250,000 Data Services credits

- 1TB of data storage

- 1 Data Cloud admin

- 100 internal Data Cloud identity users

- 1,000 Data Cloud PSL

- Five (5) integration users

Additionally, customers can obtain 2 Tableau Creator licenses as a separate line item, which their Account Executive can quote. These licenses provide access to Tableau Cloud - Creator for Data Cloud, enabling powerful data visualization capabilities. This free Data Cloud account empowers financial services companies to explore and leverage the platform's capabilities without upfront costs. It allows them to unify customers for personalized service by consolidating data across multiple orgs and data sources, providing service agents with a unified, 360-degree view of the customer. Similarly, they can unify customers for targeted marketing campaigns by creating omnichannel customer profiles. With the free Data Cloud account, financial services companies can ingest data from multiple sources, unify data with identity resolution, calculate insights, visualize data in Tableau, and view consolidated data on the contact record. This provides a low-risk opportunity to experience the benefits of Data Cloud firsthand and build a strong business case for further adoption.

Steps to Get Started with Your Free Data Cloud Account

Customers with Enterprise Edition or above can get started with Data Cloud at no cost. Here's how to activate your free account:

- Sign Up: Visit the "Your Account" section on Salesforce to sign up for Data Cloud Provisioning

- Understand What's Included: The free offering includes 250,000 Data Services credits, 1TB of data storage, 1 Data Cloud admin, 100 internal Data Cloud identity users, 1,000 Data Cloud PSL, and five (5) integration users. Unlimited Plus Edition customers will receive 2,500,000 Data Service credits.

- Tableau Integration: If you're interested in data visualization, contact your Account Executive to quote 2 Tableau Creator licenses, which provide access to Tableau Cloud - Creator for Data Cloud.

- Unify Customer Data: Use your free account to consolidate data across multiple orgs and data sources, providing a 360-degree view of the customer for personalized service and targeted marketing campaigns

- Ingest and Unify Data: Ingest data from multiple sources and unify it with identity resolution.

- Calculate Insights and Visualize Data: Calculate insights and visualize data in Tableau if you have provisioned the Tableau Cloud - Creator for Data Cloud SKU.

Conclusion

Salesforce Data Cloud is a powerful platform that enables financial services companies to unlock the full potential of their customer data. By unifying data from various sources, providing robust data management capabilities, and leveraging AI-powered insights, Data Cloud helps companies create personalized experiences, improve operational efficiency, and drive revenue growth. With the free Data Cloud account for Enterprise Edition and above customers, there's no better time to dive in and explore what this powerful platform can do for your business. By taking the steps to get started, you can unlock the full potential of your customer data and make waves in the financial services industry.

Want to learn more and get started? We are happy to help!