Enhancing Customer Experience in Financial Services through Personalization

In today's highly competitive financial services landscape, delivering exceptional customer experiences has become a key differentiator. As customers increasingly expect tailored solutions and personalized interactions, financial institutions must adapt to meet these evolving demands. Salesforce Financial Services Cloud offers a powerful platform to enhance customer experience through personalization, enabling organizations to build stronger relationships, increase customer loyalty, and drive sustainable growth.

The Power of Personalization in Financial Services

Personalization has become a buzzword in the financial services industry, and for good reason. By tailoring products, services, and interactions to individual customers' needs and preferences, financial institutions can demonstrate a deep understanding of their clients and foster a sense of trust and loyalty.

The Expectations of Modern Customers

Today's customers are more informed, empowered, and demanding than ever before. They expect financial institutions to understand their unique needs, anticipate their preferences, and deliver personalized solutions that align with their financial goals. A one-size-fits-all approach is no longer sufficient to meet these expectations.

The Benefits of Personalization

Personalization offers numerous benefits for both customers and financial institutions. For customers, personalized experiences lead to a greater sense of being valued and understood, resulting in increased satisfaction and loyalty. Personalized product recommendations and financial advice can also help customers make more informed decisions and achieve their financial objectives more effectively. For financial institutions, personalization can drive significant business outcomes. By delivering tailored experiences, organizations can increase customer engagement, cross-selling opportunities, and overall revenue growth. Personalization can also help financial institutions differentiate themselves in a crowded market, attracting and retaining high-value customers.

Salesforce Financial Services Cloud: Enabling Personalization at Scale

Salesforce Financial Services Cloud is a comprehensive platform designed to empower financial institutions to deliver personalized experiences at scale. By leveraging the power of data, artificial intelligence (AI), and seamless integration capabilities, Financial Services Cloud equips organizations with the tools and insights they need to enhance customer experience through personalization.

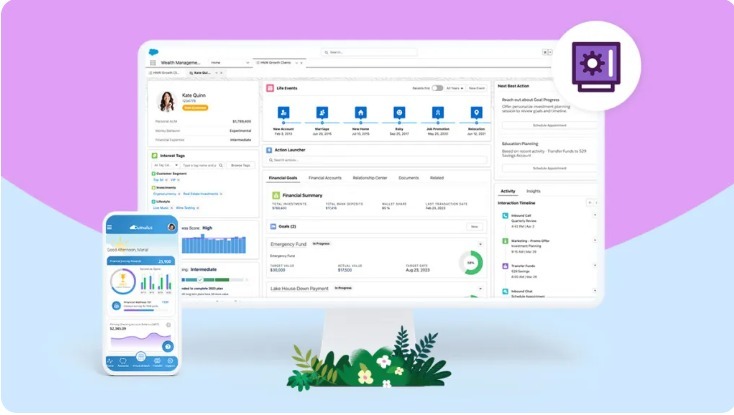

360-Degree Customer View

- At the core of personalization is a deep understanding of each customer's unique needs, preferences, and behaviors. Financial Services Cloud provides a 360-degree view of each customer by consolidating data from various sources, including customer interactions, financial transactions, and third-party data. This comprehensive customer profile serves as the foundation for delivering personalized experiences.

AI-Powered Insights and Recommendations

- Financial Services Cloud leverages AI and advanced analytics to uncover valuable insights and drive personalized recommendations. By analyzing vast amounts of customer data, the platform can identify patterns, predict customer needs, and suggest tailored product offerings or financial advice.

- For example, AI-powered insights can help financial advisors anticipate a customer's life events, such as buying a home or saving for retirement, and proactively offer relevant products or services. These personalized recommendations not only enhance the customer experience but also drive cross-selling opportunities and increase customer lifetime value.

Personalized Engagement and Communication

- Personalization extends beyond product recommendations and encompasses the entire customer journey. Financial Services Cloud enables financial institutions to deliver personalized engagement and communication across all channels, including email, mobile, and social media.

- By leveraging customer data and AI-driven insights, organizations can create targeted marketing campaigns, personalized content, and tailored messaging that resonates with each customer. This personalized approach helps build stronger relationships, increase customer engagement, and foster a sense of trust and loyalty.

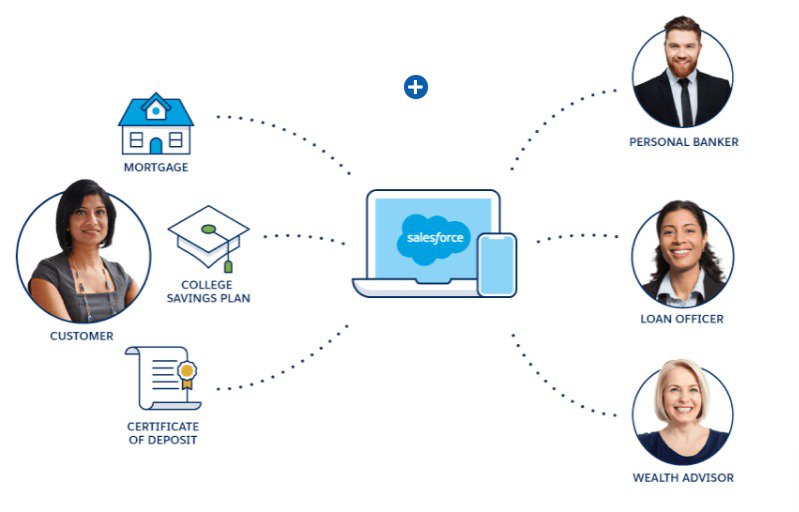

Seamless Integration and Customization

- Financial Services Cloud is built on the Salesforce platform, which offers extensive integration and customization capabilities. This allows financial institutions to seamlessly connect the Financial Services Cloud with their existing systems and data sources, ensuring a unified view of customer information.

- Moreover, the platform's customization options enable organizations to tailor the solution to their specific needs and workflows. This flexibility ensures that financial institutions can deliver personalized experiences that align with their unique business requirements and customer segments.

Conclusion

In the rapidly evolving financial services industry, personalization has become a critical component of delivering exceptional customer experiences. Salesforce Financial Services Cloud provides a powerful platform for financial institutions to enhance customer experience through personalization at scale.

By leveraging the platform's 360-degree customer view, AI-powered insights, and seamless integration capabilities, financial institutions can gain a deep understanding of each customer's unique needs and preferences. This understanding serves as the foundation for delivering personalized product recommendations, tailored financial advice, and targeted engagement across all channels.

As customer expectations continue to evolve, personalization will remain a key differentiator in the financial services industry. Financial institutions that prioritize personalization and leverage the power of platforms like Salesforce Financial Services Cloud will be well-positioned to meet the demands of modern customers and thrive in an increasingly competitive landscape.

By putting personalization at the forefront of their customer experience strategy, financial institutions can not only enhance customer satisfaction but also drive long-term growth and success. The future of financial services lies in the ability to deliver personalized, seamless, and value-added experiences that exceed customer expectations at every touchpoint. Want to learn more?