Enhancing Financial Services Productivity with Slack AI

The financial services industry is undergoing a rapid digital transformation. To stay competitive, banks, insurance companies, and wealth management firms need to leverage cutting-edge technologies to streamline operations, enhance customer experiences, and drive innovation. One of the most promising developments is the integration of artificial intelligence (AI) into collaboration platforms like Slack.

Slack recently launched a set of powerful AI features that can help financial institutions get more value out of the vast amounts of data and knowledge already stored in Slack. By bringing AI directly into the conversational interface where work happens, Slack is making it easier than ever for financial services teams to work smarter and more efficiently together. Let's explore some of the key use cases and benefits of Slack AI for the financial sector.

Instant Access to Institutional Knowledge

One of the biggest challenges in large financial organizations is enabling employees to quickly find the information they need to do their jobs. With thousands of Slack channels, documents, and messages, it can be time-consuming to manually search for answers.

Slack AI solves this with an AI-powered search that understands natural language queries. Employees can ask questions in plain English like "What is our policy for opening new accounts?" or "How do I submit an expense report?". Slack AI will instantly surface the most relevant information from past conversations and channels.

This is a game-changer for common scenarios like:

- Onboarding new employees - AI-powered search helps new hires quickly find answers and get up to speed, reducing training time.

- Resolving customer issues - Service agents can ask Slack AI for the latest procedures to handle specific customer problems, enabling faster resolutions.

- Staying updated on policies - As regulations and internal policies frequently change, Slack AI ensures employees always access the most current information.

HSBC has already seen significant productivity gains from Slack AI. Their developers created an AI-powered knowledge base that has increased productivity by 26% by enabling teams to instantly find solutions without asking repetitive questions.

Rapid Knowledge Sharing and Decision Making

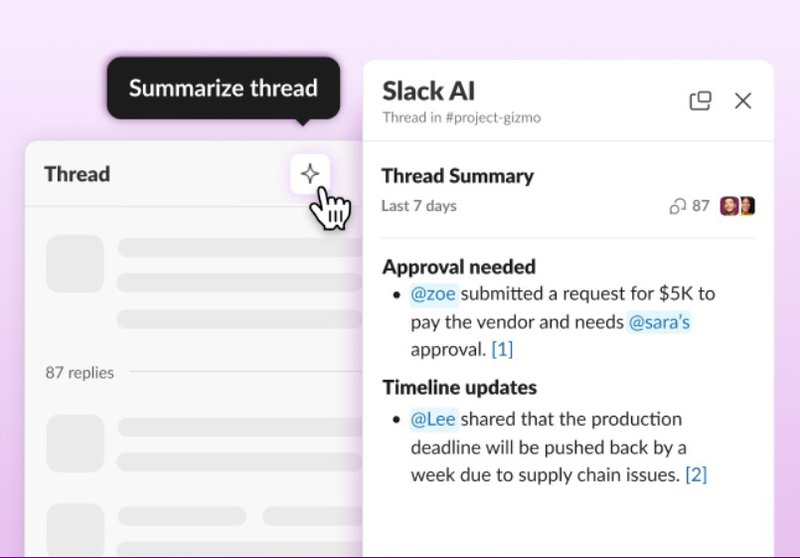

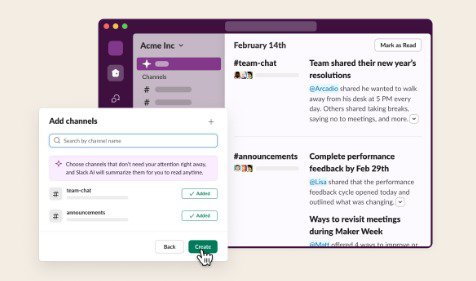

Another key benefit of Slack AI for financial firms is the ability to automatically summarize and share knowledge across teams and departments. With features like channel summaries and AI-powered recaps, Slack makes it easy to distill key information and decisions from hundreds or thousands of messages.

For example, investment and portfolio management teams can leverage Slack AI to quickly disseminate market insights and research:

- Analysts can drop research reports into Slack channels

- Slack AI automatically generates concise summaries that highlight the key takeaways

- Portfolio managers and executives can skim the AI-generated recaps to rapidly absorb the crucial points without reading long documents

UK-based investment manager M&G is using Slack's AI channel summaries in exactly this way. Summaries enable more employees to discover important data that drives investment decisions and innovation. By breaking down silos and making knowledge-sharing frictionless, Slack AI accelerates decision-making.

Automating Workflows and Integrating Systems

Financial services firms rely on dozens or even hundreds of specialized applications, from trading platforms and portfolio management tools to CRM and compliance software. Switching between these disparate systems is a major source of inefficiency and reduced productivity.

Slack AI integrates with over 2,200 applications, enabling firms to consolidate tools into one central hub. Employees no longer need to constantly switch contexts - they can access client records, submit trades, generate reports, and more, all from within Slack.

What's more, Slack's no-code workflow builder allows teams to automate routine processes easily by connecting these integrated apps. For example:

- A Salesforce record for a new high-value client is updated

- This automatically triggers a Slack workflow

- The workflow notifies the account team in Slack and schedules a welcome call

- It also creates an encrypted Slack Connect channel to securely collaborate with the client

By streamlining workflows across systems, Slack AI enables financial services teams to spend less time on administrative tasks and more time on high-value work.

Secure Collaboration with Clients and Partners

Financial services is a heavily regulated industry, and compliance is always a top concern when adopting new technologies. Slack was built from the ground up with enterprise-grade security and compliance in mind.

Slack AI is hosted entirely on Slack's secure infrastructure and adheres to key industry standards like FINRA, GDPR, and FedRAMP. Encryption, data loss prevention, and granular access controls ensure that sensitive financial data is protected.

Slack Connect enables financial institutions to securely collaborate with external parties like clients, brokers, and vendors. All communication is encrypted and subject to the same retention and DLP policies as internal Slack data.

For example, Wells Fargo uses Slack Connect to securely share information with independent financial advisors. Advisors can access real-time updates on products, rates, and policies, while Wells Fargo maintains strict control over permissions and data sharing.

The Future of Financial Services Productivity

The financial services industry is at an inflection point. Firms that embrace digital transformation and AI-powered technologies will be positioned to thrive, while laggards risk being left behind.

Slack AI represents the next frontier of productivity for financial institutions. By bringing the power of AI to the place where work already happens, Slack is helping the industry work smarter.

From instantly accessing institutional knowledge to streamlining decision-making to automating workflows, the use cases for Slack AI in financial services are vast and still being discovered. Industry leaders like HSBC, M&G, and Wells Fargo are already realizing significant efficiency gains.

As Slack continues to innovate rapidly with upcoming features like AI-powered digests and tighter integration with Salesforce's Einstein Copilot, the future of financial services productivity is exciting. Firms that adopt Slack AI today will be gaining an immediate competitive edge.