Salesforce Doubles Down on Financial Services in 2024: What it means to this sector?

2024 is shaping up to be a landmark year for Salesforce in the financial services sector, with a slew of new product announcements, strategic partnerships, and a renewed focus on bringing the power of CRM, data, and AI to banks, asset and wealth management firms, and insurance companies. Salesforce is poised to transform the fintech landscape. As a Salesforce implementation partner specializing in financial services, we're excited about the opportunities this presents for our clients. Here are some highlights:

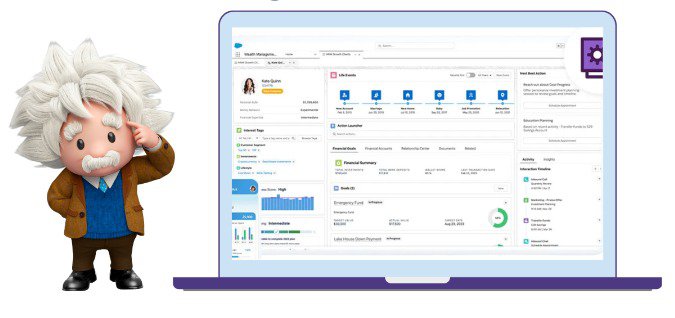

Einstein Copilot for Financial Services Cloud

The new Einstein Copilot, powered by generative AI, is now seamlessly integrated into the Financial Services Cloud. This will allow bankers, financial advisors, and service agents to interface using natural language, get automated insights, and receive AI-driven recommendations - all while providing guardrails on usage. Einstein Copilot has the potential to significantly streamline financial analysis workflows and enhance decision-making.

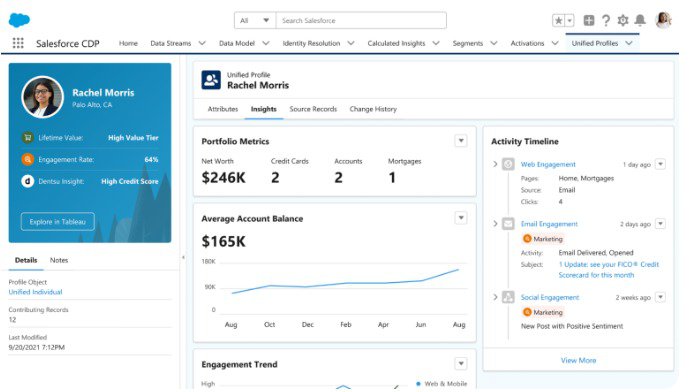

Expanded Data Cloud for Financial Services

Salesforce is making it easier to unify customer data across financial institutions' systems with expanded connectors and integration tools. The Customer Insights capability provides a 360-degree view of clients by connecting interaction, behavioral, and transactional data. New dashboards show client cash flow insights and spending trends. This unified data foundation is key to delivering personalized financial advice at scale.

Actionable Segmentation and List Building

New Actionable Segmentation features allow financial marketers and advisors to build targeted lists of contacts for priority outreach based on Data Cloud segments. Lists can be filtered, measured with KPIs, and synced with refreshed data. This will help drive more relevant and timely client engagement.

Industry-Specific Automation and Components

Salesforce continues to expand its library of pre-built workflows, AI models, and Lightning components designed specifically for financial services. Use cases include streamlined onboarding, intelligent referrals, transaction dispute management, and more. These accelerators enable faster time-to-value for financial institutions deploying Salesforce.

Tableau CRM Analytics for Financial Services

Tableau CRM (formerly Einstein Analytics) now includes dashboards and AI models tailored for retail banking, wealth management, and insurance. These insights, powered by Data Cloud, help surface opportunities and risks across client portfolios and segments. Tableau's natural language interface makes it easy for financial professionals to ask questions and get automated insights.

What It Means for Financial Institutions

The financial services industry is in the midst of a massive digital transformation as customers demand more personalized, intelligent, and connected experiences. Salesforce's latest innovations are designed to help financial institutions meet these expectations while driving efficiencies. Some of the key benefits and opportunities for banks, insurers, and wealth management firms include:

- Deliver proactive advice at scale: By leveraging AI tools like Einstein Copilot and Tableau CRM analytics, financial advisors can provide clients with timely, personalized recommendations across their financial lives - from budgeting to investing to retirement planning. Predictive models can identify the next best action or offer for each customer.

- Streamline customer service: Pre-built service workflows and virtual agent bots enable faster case resolution, while AI assists agents with recommendations. Self-service portals allow customers to easily open accounts, submit applications, and manage transactions.

- Unify the customer experience: With a complete customer 360 profile powered by Data Cloud, financial institutions gain a holistic view across every touchpoint and interaction. This helps eliminate data silos and inconsistencies as customers move between departments and channels.

- Increase marketing ROI: Advanced segmentation capabilities allow marketers to build precise audiences and journeys tailored to client's financial goals and life events. Einstein Engagement Scoring predicts the likelihood of clients engaging or churning.

- Accelerate innovation: The Salesforce platform enables financial institutions to rapidly develop and launch new products and services. Low-code tools empower business users to automate processes and build branded experiences without heavy IT lifting.

Wealth Management: Empowering Advisors to Deliver Personalized Guidance at Scale

The latest innovations in Financial Services Cloud enable advisors to:

- Gain an improved 360-degree view of clients: By unifying data across systems, advisors can access a comprehensive profile of each client's financial goals, investment preferences, life events, and interactions. This empowers them to deliver highly personalized advice.

- Automate workflows and compliance: Advisors can streamline client onboarding, account opening, and KYC processes with automated workflows. Pre-built industry components ensure compliance with evolving regulations.

- Collaborate seamlessly with clients: Wealth managers can engage clients on their preferred channels, co-browsing financial plans and executing transactions in real time. Relationship intelligence insights help advisors nurture key client relationships.

- Leverage AI-powered analytics: Einstein Discovery uncovers insights into client segments, predicts churn risk, and recommends the next best actions. Tableau CRM provides wealth managers with interactive dashboards to track assets, anticipate client needs, and grow their book of business.

Asset Management: Driving Operational Efficiency and Premium Client Service

Salesforce is helping asset managers streamline operations, reduce costs, and deliver premium service in an increasingly competitive landscape. Key capabilities include:

- Streamlined sales and service: Asset managers can empower wholesalers and service teams with a unified view of clients and portfolios. Einstein Bots and guided service flows enable faster case resolution.

- Automated client reporting: Client statements, fund fact sheets, and portfolio reviews can be automatically generated and distributed via each client's preferred channel. This frees up time for value-added activities.

- Scalable data integrations: MuleSoft enables asset managers to seamlessly connect portfolio accounting, transfer agency, and other back-office systems with Salesforce. This provides a real-time, reliable data foundation.

- Predictive analytics: Asset managers can leverage Einstein Discovery to analyze product flows, anticipate client needs, and identify cross-sell opportunities. Tableau CRM provides interactive AUM dashboards and sales performance insights.

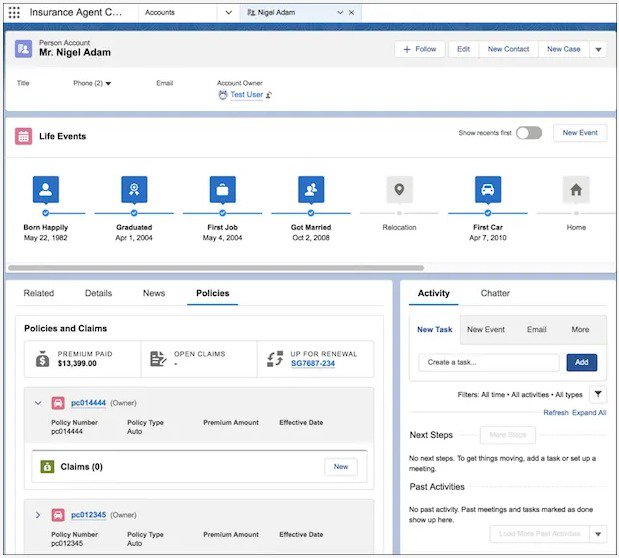

Insurance: Delivering Efficient, Personalized Experiences Across the Policy Lifecycle

Salesforce is enabling insurers to transform how they engage policyholders, streamline operations, and innovate products. Insurers can leverage Salesforce to:

- Streamline policy administration: Insurers can automate the entire policy lifecycle from quoting to underwriting to servicing. Guided workflows, document generation, and e-signature capabilities accelerate processes.

- Personalize policyholder engagement: By unifying policyholder data across systems, insurers gain a complete view to tailor interactions. Einstein Bots and omnichannel service tools enable faster, smarter service. Personalized marketing journeys nurture relationships.

- Optimize underwriting and claims: Insurers can leverage Einstein Discovery to predict risk more accurately, flag potentially fraudulent claims, and optimize settlement. Automated workflows route complex cases to the right experts.

- Launch innovative products: Insurers can rapidly launch usage-based, parametric, and other data-driven products using flexible rating and low-code tools. Embedded insurance APIs enable seamless distribution via partner ecosystems.

The Future is Bright

As we look ahead, Salesforce is well-positioned to help wealth managers, asset managers, and insurers lead the way in the digital-first world. With continuous innovation across data unification, AI, automation, and personalization, Salesforce empowers financial institutions to drive efficiency, growth, and client loyalty. The future of financial services is one where advisors spend less time on manual tasks and more time delivering valuable guidance., where asset managers can scale intelligently to meet rising investor expectations. And where insurers can provide proactive protection personalized to each policyholder.