Salesforce State of Sales Report: Key Insights for Financial Services

The recently released 6th edition of the Salesforce State of Sales report surveyed 5,500 sales professionals worldwide to uncover the latest trends, challenges, and strategies driving sales growth. Several insights emerged that are especially relevant for financial services organizations looking to expand their business in an increasingly competitive and complex selling environment.

Sales Growth is Back, But New Pressures Emerge

The good news is that sales growth has returned, with 79% of sales leaders reporting increased revenue over the past year. However, this growth is accompanied by intensifying pressures:

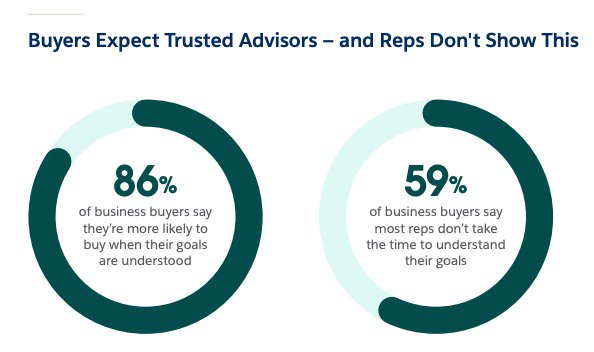

- Sales leaders cited changing customer needs and expectations as the top challenge. Financial services clients are demanding more personalized engagement focused on their unique goals. 59% of buyers say reps fail to demonstrate an understanding of their specific objectives.

- Marketplace competition is getting fiercer, with 57% of sellers saying competition has gotten trickier since last year. Legacy financial firms and new entrants are vying for the same customers.

- Sales reps are struggling to meet quotas amid these pressures. 67% don't expect to meet their quota this year, and 84% missed it last year.

To overcome these obstacles, financial services sales teams need to focus on delivering value to clients through a deep understanding of their needs, enabled by the right training and technology. This is where a complete CRM platform like Salesforce can be a game-changer.

The AI Imperative for Financial Services

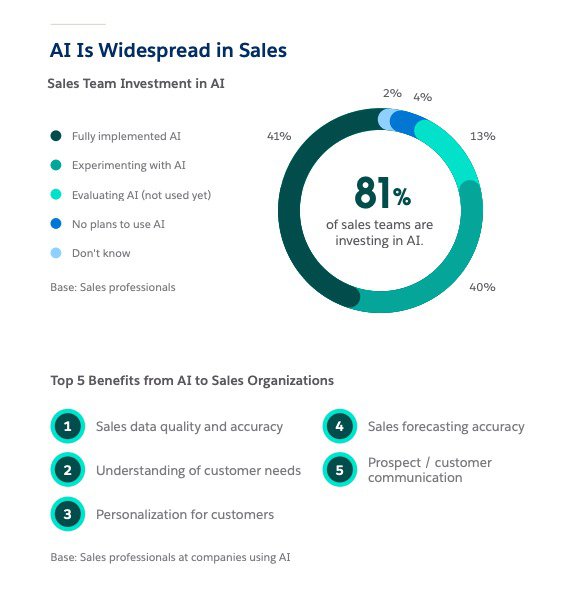

Artificial intelligence is rapidly becoming a must-have capability for sales organizations. 81% of sales teams say they use some form of AI today. Those that have adopted AI are seeing significant advantages:

- 83% of teams using AI saw revenue growth in the past year, compared to only 66% of teams not using AI.

- The top benefits of AI for sales include improved data quality and accuracy, a better understanding of customer needs, enhanced personalization, more accurate forecasting, and streamlined customer communications.

However, implementing AI does come with challenges around budget, training, data quality, and security, which need to be carefully navigated. Financial services firms, in particular, must ensure airtight data governance given the sensitivity of client financial data.

Salesforce embeds AI-powered automation and insights directly in the CRM workflow, enabling reps to work smarter while maintaining the highest standards of data security and privacy that financial services demand. Features like Einstein Conversation Insights help coach reps on client calls, while Einstein Forecasting predicts revenue outcomes.

Doubling Down on Sales Enablement

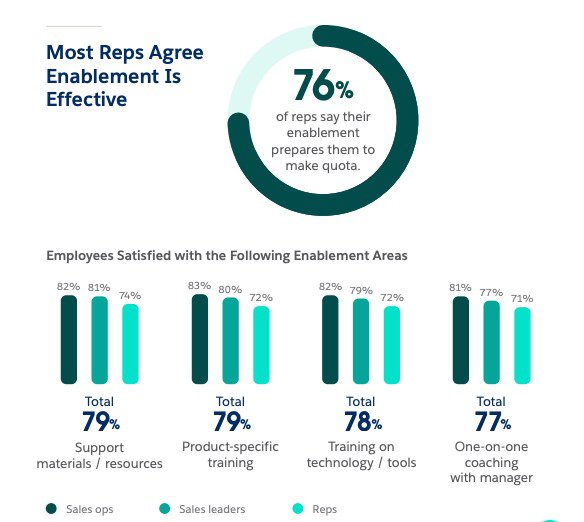

To prepare reps for success in this high-pressure environment, financial services sales leaders are prioritizing sales enablement and training as the #1 tactic for driving growth. Satisfaction with enablement programs is high, with 76% of reps agreeing that their training prepares them to meet quotas. The most impactful programs focus on:

- Tying training to customer needs so reps can communicate value

- Providing reps with intelligent insights and resources in the moment

- Reinforcing training with ongoing coaching and feedback

However, many enablement activities like 1:1 coaching sessions are difficult to scale consistently. This is where Salesforce can help, with AI-powered tools like Sales Enablement that deliver real-time guidance and recommend the best actions, content, and training for each selling scenario.

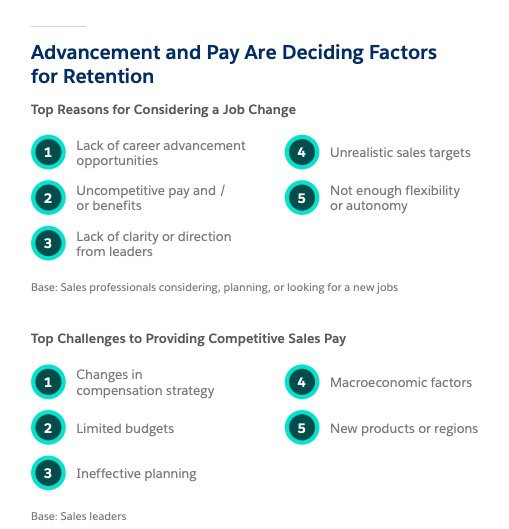

Optimizing Compensation to Retain Top Talent

While employee retention in sales has risen to 82%, it remains highly dependent on providing competitive compensation and career advancement opportunities. 64% of sales reps say they would leave for a similar role with better pay. To retain top performers, financial services firms need to get smarter about incentive compensation. However, sales leaders cite challenges in designing competitive comp plans, including changing business needs, limited budgets, and ineffective planning. Salesforce provides Incentive Compensation Management to help model and optimize plan scenarios, motivate reps with real-time visibility into commissions, and automate payouts. Tools like these allow financial services revenue leaders to build comp plans that drive the right behaviors.

The Path to Future Growth

As financial services sales teams look to the future, the path to growth will rely on a three-pronged strategy:

- Enabling reps with training and tools to deliver personalized value to clients

- Adopting AI-powered insights and workflow automation to boost productivity

- Optimizing plans and territories to motivate and retain top talent

The key is having a complete growth platform that integrates all of these capabilities in one place. With Salesforce Sales or Financial Services Cloud, financial services firms can:

- Gain a 360-degree view of each client to anticipate their unique needs

- Coach reps in the moment with AI-powered insights and enablement

- Automate manual tasks so reps can spend more time actually selling

- Make smarter decisions with predictive forecasting and pipeline inspection

- Motivate reps with transparent and optimized incentive comp plans

By leveraging the power of Salesforce, financial services organizations can drive efficient growth, even in the face of economic uncertainty and market complexity. The opportunity is there for those who embrace it.

To learn more about how Salesforce can help your financial services firm reach new heights, contact us at Vantage Point. As a top 25 Salesforce partner, we can help you unleash the full potential of the world's #1 CRM to supercharge your revenue growth.