Unlocking Team Productivity with Salesforce Copilot for Financial Services

Artificial intelligence is transforming workflows across industries by automating tasks and providing data-driven insights instantly. AI-powered digital assistants can become invaluable teammates for financial advisors, insurance agents, and bankers looking to improve productivity and customer service. Salesforce Copilot is a new AI-powered conversational assistant built directly into Salesforce. It uses natural language processing to allow users to ask questions conversationally and get quick, relevant answers grounded in their own company’s data stored in Salesforce. It aims to help professionals get answers, automate processes, and close deals faster. This post covers the key capabilities of Copilot, including benefits for financial services, main features, and real-world use cases.

Why Copilot for Financial Firms

Copilot taps into a company’s data that is stored within Salesforce and external sources to provide personalized recommendations directly within Salesforce apps like Financial Services Cloud, Sales Cloud, Service Cloud, and Slack. It helps financial teams to:

Increase Productivity

- Surface relevant information like client briefs, policy documents, etc. conversationally

- Automate manual workflows like data entry to focus on high-value work

- Reduce repetition by answering common questions instantly

Improve Client Service

- Quickly match clients to the right financial products using data insights

- Provide personalized service at scale by understanding each customer’s unique needs

- Speed up case resolution with quick answers to complex questions

- Deliver consistent onboarding and issue resolution across service teams

Accelerate Growth

- Identify the best leads and opportunities based on historical deal data

- Close deals faster with customized close plans

- Personalized emails to prospects

- Confidently prepare proposals with predictive sales insights

- Speed up account, contact, and opportunity creation with AI automation

Key Features of Copilot

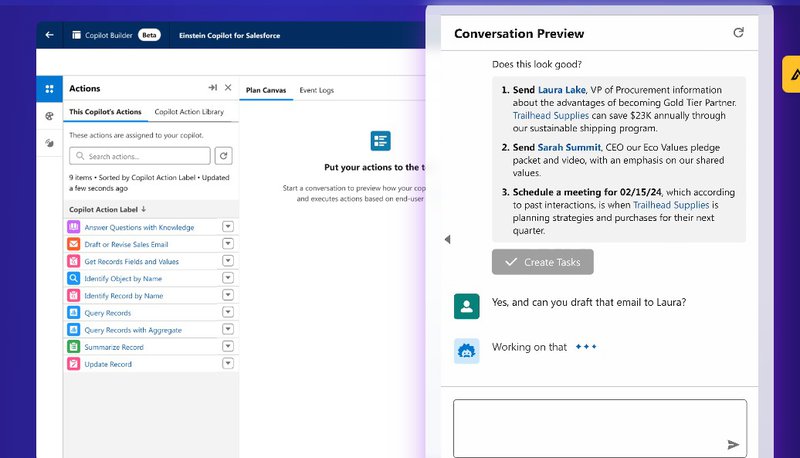

Copilot aims to serve as a trusted “co-pilot” alongside financial teams by providing the following key capabilities:

Conversational Information Retrieval

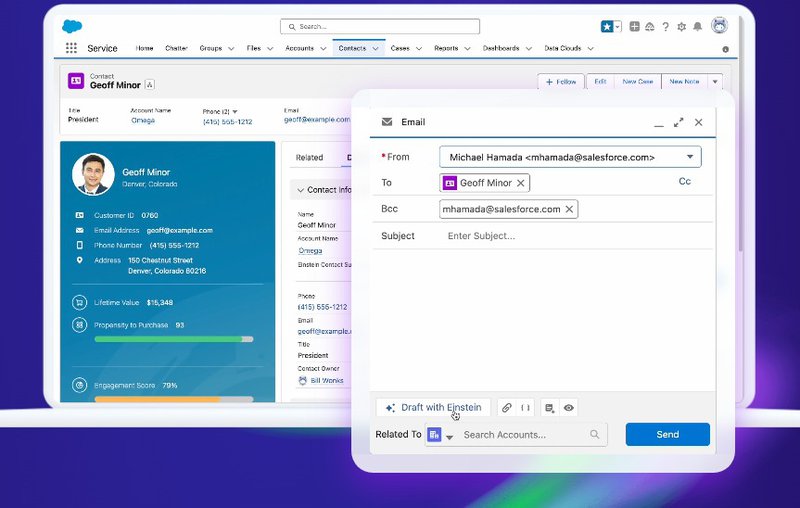

Users can ask questions naturally in Salesforce and Slack to get quick answers about clients, deals, compliance policies, etc., without needing to remember keywords.

Intelligent Document Comprehension

Copilot reads and analyzes text and data in documents like client briefs, underwriting guidelines, past proposals, etc., to highlight relevant snippets that inform the next steps.

Predictive Sales & Service Recommendations

Leveraging data on past deals and service interactions, Copilot offers next-best-action guidance tailored to each customer for optimal outcomes.

Workflow & Meeting Automation

Copilot can automatically schedule meetings, assign follow-up tasks, update records, etc., to reduce repetitive manual work.

Integrated Salesforce Search

Users get a single search box to find contacts, documents, conversations, etc., across Sales, Service & Slack rather than recreating search in multiple places.

Use Cases for Financial Firms

Financial institutions globally can use Copilot to enhance productivity, client service, and growth in areas like:

Lead Prioritization for Wealth Management

Based on client demographics, past deals, and market trends, Copilot identifies the leads most likely to convert so financial advisors can focus their efforts on the best opportunities.

Client Onboarding for Retail Banking

By reviewing past account opening forms and conversations, Copilot expedites onboarding for new banking customers by auto-filling repetitive fields.

Policy Renewals for Insurance

Copilot tracks expiration dates for existing insurance policies and prompts agents to renew with historical details about coverage limits, claims, etc.

Customer Service for Fintech Apps

AI assistants help users of finance apps resolve account, payment, and transaction issues faster by analyzing support conversations to answer questions instantly.

Conclusion

With an industry-specific recommendation engine embedded directly into Salesforce and while using a customer's own data, Copilot has immense potential to enhance productivity, service, and growth for financial firms without disrupting workflows. As an AI assistant designed for the enterprise, Copilot lets bankers, advisors, and agents tap into data-driven insights tailored to their business needs right from the tools they use daily. It serves as an always-on “co-pilot” ready to help at the point decisions are being made.

Let's talk!