Vantage Point’s May Insights : Empowering Financial Services with Salesforce AI

Welcome to Vantage Point's monthly newsletter, where we recap the latest insights on how Salesforce is transforming the financial services industry. In this edition, we highlight our May blog series, which showcased how Salesforce's cutting-edge AI capabilities are empowering wealth managers, asset managers, and insurers to deliver exceptional client experiences and drive growth.

Vantage Point Enables Leading Wealth Firm's Vision for Next-Gen AI-Powered Advisors

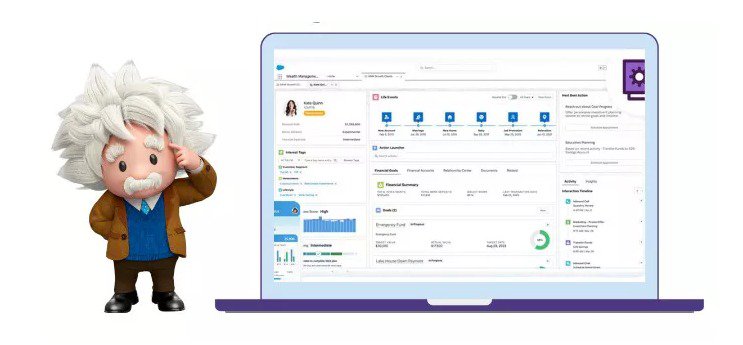

We kicked off the month by sharing the story of a leading wealth advisory firm's bold vision to empower its advisors with next-generation AI. Vantage Point collaborated closely with the firm's stakeholders and Salesforce to evaluate upgrading to the advanced Einstein AI platform.

Through detailed discovery sessions, demos, cost-benefit analyses, and roadmap planning, we helped build the business case and confidence in adopting Einstein AI. The wealth firm recognized Einstein's potential to provide automated client insights, hyper-personalized advice, and generative AI assistance to streamline advisor workflows.

By combining Salesforce's industry-leading AI with Vantage Point's deep financial services expertise, the firm is now poised to revolutionize how they deliver wealth management and drive growth. Read more >>

Salesforce Doubles Down on Financial Services in 2024

Next, we explored Salesforce's expanded commitment to transforming financial services in 2024. Enhancements span AI-powered analytics, unified data, automation, and industry-specific tools:

- Einstein Copilot for Financial Services Cloud: Seamlessly integrated generative AI enables bankers and advisors to get automated insights and recommendations.

- Expanded Data Cloud: New connectors and Customer Insights provide a 360-degree client view by unifying interaction, behavioral, and transactional data.

- Industry-Specific Automation: Pre-built workflows accelerate use cases like onboarding, dispute management, and more.

- Tableau CRM Analytics: Dashboards and AI models tailored for banking, wealth management, and insurance surface opportunities and risks.

For wealth managers, these innovations enable a 360-degree client view, automated onboarding, AI-driven next-best actions, and interactive AUM dashboards. Asset managers can streamline sales and service, automate client reporting, and predict opportunities. Insurers can transform the policy lifecycle from personalized quoting to AI-optimized underwriting and claims. Salesforce is empowering financial institutions to drive efficiency, personalization, and innovation. Discover how >>

Navigating Change Management: Strategies for Successful Salesforce Transformation

However, realizing the full potential of Salesforce and AI requires effective change management. Our third post provided strategies for navigating the organizational transformation that comes with a Salesforce implementation.

Key success factors include:

- Developing a clear vision and roadmap

- Engaging employees through communication and training

- Identifying change champions to lead adoption

- Aligning stakeholders and managing resistance

- Providing comprehensive training and support

- Measuring and celebrating success

Vantage Point specializes in guiding financial services firms through this change journey. We conduct assessments to identify adoption barriers, develop targeted communication and training plans, and provide ongoing support to ensure seamless integration of Salesforce into processes and culture.

With Vantage Point as a trusted partner, firms can confidently manage change and maximize the value of their Salesforce investment. Learn more >>

Salesforce Summer '24 Release: Empowering Financial Services with Cutting-Edge Features

Finally, we took a deep dive into the Salesforce Summer '24 Release, which brings a wave of enhancements tailored for financial services:

- Einstein Copilot for Financial Services Actions: AI-powered assistance for insurance service reps to generate account summaries and renewal communications.

- Digital Lending: Unified loan origination and servicing platform to streamline lending processes.

- Transaction Dispute Management: Enhanced integrations and orchestration to accelerate dispute resolution.

- Automation Platform: Stage management and integration visibility to optimize complex processes.

- Policyholder Self-Service Portal: A Unified portal for policyholders to access policy details, claims, and service requests.

- Personalized Financial Engagement: Enriched customer profiles and insights to drive tailored advice and offers.

Unlocking the full potential of these capabilities requires the right expertise and guidance. Vantage Point's certified Salesforce experts provide end-to-end implementation services to ensure a seamless transition and optimal utilization. We work closely with clients to align Salesforce with their unique objectives and needs. Explore how >>

The Path Forward

As financial services firms navigate the rapid pace of digital transformation, Salesforce continues to innovate and deliver cutting-edge AI capabilities to help them thrive. From Einstein Copilot's generative AI assistance to unified data and analytics, from industry-specific automation to self-service portals, Salesforce is empowering institutions to elevate the customer experience and drive growth.

However, technology alone is not enough. Effective change management is critical to realizing the full value of a Salesforce transformation. Vantage Point stands ready to be a trusted guide on this journey. With our deep financial services expertise, proven change management approach, and close partnership with Salesforce, we help firms navigate complexity and achieve their vision.

The future of financial services is one where advisors have intelligent tools at their fingertips to deliver proactive, hyper-personalized guidance at scale. Where wealth managers and asset managers can unify data, automate processes, and uncover actionable insights to grow their business efficiently. And where insurers can transform the end-to-end policy lifecycle to provide seamless, tailored customer experiences.

Vantage Point is excited to help financial institutions bring this future to life. Let us be your partner in harnessing the power of Salesforce and AI to transform your business.

Contact us to start the conversation.